Table of Contents

Prologue to Lab-Grown Diamonds

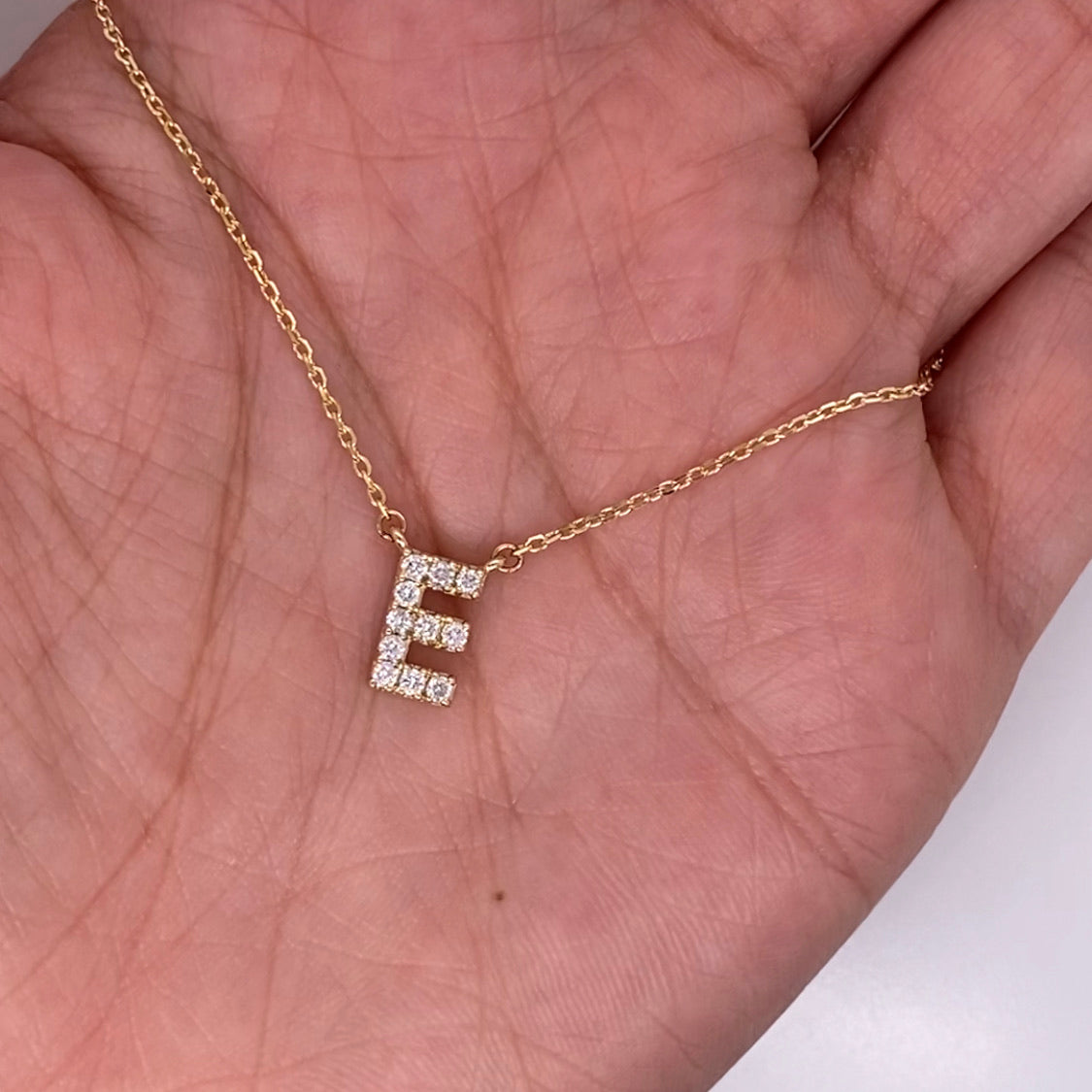

In the realm of diamonds, an upset is unfurling. Lab-grown diamonds have arisen as an impressive option in contrast to normal diamonds, offering a mix of moral contemplations, monetary worth, and mechanical development. As we explore through the 21st 100 years, the investment capability of lab-grown diamonds turns out to be progressively convincing. This article digs into the features of lab-grown diamonds, introducing a thorough manual for their investment possibilities.

Understanding Lab-Grown Diamonds

Lab grown diamonds investment, otherwise called engineered diamonds or man-made diamonds, are made utilizing progressed innovative cycles that emulate the normal development of diamonds. These diamonds are indistinguishable from regular diamonds in synthetic sythesis, precious stone design, and optical properties. Two essential techniques utilized in their creation are High Strain High Temperature (HPHT) and Synthetic Fume Statement (CVD).

HPHT Strategy

The HPHT strategy includes exposing carbon to high strain and high temperature, duplicating the regular precious stone arrangement process. This procedure produces diamonds that are undefined from normal diamonds in each perspective.

CVD Strategy

The CVD strategy utilizes a carbon-rich gas combination. A precious stone seed gem is set in a vacuum chamber, where the gas is ionized, permitting carbon particles to store onto the seed, shaping a jewel layer layer. This strategy offers more noteworthy command over the precious stone’s properties, like size and immaculateness.

Benefits of Putting resources into Lab-Grown Diamonds

Moral and Ecological Advantages

One of the essential benefits of lab grown diamonds is their moral creation. Customary jewel mining has for some time been related with ecological corruption and denials of basic liberties. Lab-grown diamonds wipe out these worries, giving a contention free and naturally feasible other option. This moral allure reverberates emphatically with current buyers, especially among more youthful ages who focus on maintainability.

Cost Proficiency

Lab-grown diamonds are and large 30-40% more affordable than their normal partners. This cost effectiveness permits financial backers to procure bigger or better diamonds at a similar cost, expanding their investment potential. As the innovation propels, creation costs are supposed to diminish further, possibly expanding the benefit of existing lab-grown diamonds.

Quality and Immaculateness

Lab-grown diamonds frequently display less considerations and blemishes than regular diamonds, because of the controlled creation climate. This predominant quality upgrades their attractiveness in both the adornments market and modern applications, further cementing their investment bid.

Market Elements and Investment Potential

Rising Interest

The interest for lab-grown diamonds is on a consistent ascent. As indicated statistical surveying, the worldwide lab-grown jewel market is supposed to develop at a CAGR of 22% from 2021 to 2030. This development is driven expanding customer mindfulness and acknowledgment, combined with headways in jewel developing advances that improve quality and decrease creation costs.

Modern Applications

Past adornments, lab-grown diamonds have huge applications in different businesses, including gadgets, aviation, and clinical gadgets. Their unrivaled hardness, warm conductivity, and electrical protection properties make them significant in these areas. The extending modern utilizations of lab-grown diamonds further reinforce their investment potential.

Investment Vehicles

Financial backers can acquire openness to the lab-grown jewel market through different channels. Direct acquisition of diamonds, putting resources into precious stone creating organizations, or taking part in jewel upheld protections are a portion of the ways of effective financial planning. Every vehicle offers different gamble profiles and likely returns, permitting financial backers to fit their investment technique to their gamble resilience and monetary objectives.

Difficulties and Contemplations

Market Acknowledgment

While the acknowledgment of lab-grown diamonds is developing, a few sections of the market actually favor regular diamonds because of their verifiable worth and saw extraordinariness. Financial backers should consider market opinion and the expected effect on resale esteem.

Innovative Reliance

The worth of lab-grown diamonds is intently attached to innovative headways. Any critical advancement that radically diminishes creation expenses could influence the market benefit of existing diamonds. Remaining informed about mechanical patterns and advancements in precious stone creation is vital for financial backers.

Administrative Climate

The administrative scene for lab-grown diamonds is developing. Financial backers should keep up to date with changes in guidelines that could affect the market, like exposure prerequisites and labeling norms. Consistence with these guidelines is fundamental to keep up with market trust and safeguard investment esteem.

Future Standpoint

The fate of lab-grown diamonds as an investment looks encouraging. As purchaser inclinations shift towards feasible and moral items, lab-grown diamonds are ready to catch a huge portion of the precious stone market. Proceeded with mechanical progressions will probably upgrade the quality and reasonableness of lab-grown diamonds, further driving their interest.

Mechanical Advancements

Progressing innovative work in precious stone developing advancements hold the possibility to change the business. Advancements that further develop proficiency, diminish expenses, and improve the nature of lab-grown diamonds will probably support their investment claim. Financial backers ought to screen these progressions to exploit arising open doors.

Supportability Patterns

The worldwide accentuation on supportability and capable obtaining will keep on leaning toward lab-grown diamonds. Financial backers who adjust their portfolios to these patterns are probably going to profit from the developing interest for eco-accommodating and morally delivered diamonds.

Conclusion

Lab-grown diamonds address an interesting and promising investment opportunity. Their moral creation, cost proficiency, and predominant quality make them an appealing option in contrast to normal diamonds. As the market for lab-grown diamonds extends, driven rising interest and mechanical developments, their investment potential is set to develop. Financial backers who perceive and profit this pattern stand to acquire huge returns in the years to come.